Realize the Huge Potential for PET Bottle Business

The global plastics industry is observing a continuous shift of production bases to low-cost Asian countries. With increasing foreign investment and rise in the number of new manufacturing establishments in the region, Asia has become the largest and the fastest growing market for plastics in the world. In particular, China and India offer enormous growth opportunities due to expanding production activities in the countries.

The global plastics industry is observing a continuous shift of production bases to low-cost Asian countries. With increasing foreign investment and rise in the number of new manufacturing establishments in the region, Asia has become the largest and the fastest growing market for plastics in the world. In particular, China and India offer enormous growth opportunities due to expanding production activities in the countries.

Plastic consumption for packaging in India is expected to reach 10.0 million tons by 2020. The FMCG sector compiled with rise in capital investment pose as the key growth drivers for the packaging industry in the country. The consumer base for several commodities in India, especially FMCGs is expanding due to the rising disposable income of the population.

The demand for packaging of these products has lead to the development of the plastic packaging industry in the country. Among the vast family of plastics, Polyethylene Terephthalate, popularly known as PET, is expected to grow the fastest at 11.0% annually. Majority of the PET available in India is utilized in the production of bottles. In the recent years, PET bottles have inundated the Indian market, with annual growth rate in consumption exceeding 20.0%.

The demand for packaging of these products has lead to the development of the plastic packaging industry in the country. Among the vast family of plastics, Polyethylene Terephthalate, popularly known as PET, is expected to grow the fastest at 11.0% annually. Majority of the PET available in India is utilized in the production of bottles. In the recent years, PET bottles have inundated the Indian market, with annual growth rate in consumption exceeding 20.0%.

The consumption of PET bottles is increasing on account of the behavioural change in consumerism. New customers being created for bottled beverages as well as an increasing number of products being replaced with PET bottles. Even then the per capita consumption of PET is very low in India at 0.3 kg vis-à-vis the global average of 2 kg. This shows that there is a significant growth opportunity for PET bottles in India. The PET preforms market in India is anticipated to grow substantially on account of the shifting preference from glass bottles to PET bottles, rising demand for consumer goods and packaged drinking water, and the development of retail channels in the country.

Why Innovative Tech Pack

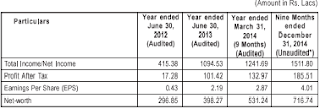

Innovative Tech Pack Ltd., incorporated in the year 1989. its key Products/Revenue Segments include Bottles which contributed Rs 36.35 Cr to Sales Value (47.24% of Total Sales), Jars which contributed Rs 33.01 Cr to Sales Value (42.90% of Total Sales), Caps which contributed Rs 6.05 Cr to Sales Value (7.86% of Total Sales), Sale of services which contributed Rs 1.26 Cr to Sales Value (1.63% of Total Sales). For the quarter ended 31-Mar-2015, the company has reported a Standalone sales of Rs. 23.99 Cr., up 29.73% from last quarter Sales of Rs. 18.49 Cr. and up 8.96% from last year same quarter Sales of Rs. 22.01 Cr. Company has reported net profit after tax of Rs. 1.85 Cr. in latest quarter.

A Turnaround Story

1. For the quarter ended ended March 31, 2015, the company's net sales/income from operations was INR 239.87 million compared to INR 184.7 million a year ago. 2. Profit from operations before other income, interest and exceptional items was INR 44.86 million compared to INR 20.18 million a year ago.

3. Profit from ordinary activities before tax was INR 18.504 million compared to INR 11.713 million a year ago.

4. Net profit was INR 18.504 million compared to INR 11.713 million a year ago.

5. Profit from operations before other income, interest and exceptional items was INR 82.31 million compared to INR 65.37 million a year ago.

6. Profit from ordinary activities before tax was INR 33.54 million compared to loss from ordinary activities before tax of INR 22.39 million a year ago.

7. Net profit was INR 33.54 million compared to net loss of INR 22.39 million a year ago.

8. Basic and diluted earnings per share before and after extraordinary items was INR 1.53 compared to loss per share of INR 1.02 a year ago.

Why Innovative Tech Pack

Innovative Tech Pack Ltd., incorporated in the year 1989. its key Products/Revenue Segments include Bottles which contributed Rs 36.35 Cr to Sales Value (47.24% of Total Sales), Jars which contributed Rs 33.01 Cr to Sales Value (42.90% of Total Sales), Caps which contributed Rs 6.05 Cr to Sales Value (7.86% of Total Sales), Sale of services which contributed Rs 1.26 Cr to Sales Value (1.63% of Total Sales). For the quarter ended 31-Mar-2015, the company has reported a Standalone sales of Rs. 23.99 Cr., up 29.73% from last quarter Sales of Rs. 18.49 Cr. and up 8.96% from last year same quarter Sales of Rs. 22.01 Cr. Company has reported net profit after tax of Rs. 1.85 Cr. in latest quarter.

A Turnaround Story

1. For the quarter ended ended March 31, 2015, the company's net sales/income from operations was INR 239.87 million compared to INR 184.7 million a year ago. 2. Profit from operations before other income, interest and exceptional items was INR 44.86 million compared to INR 20.18 million a year ago.

3. Profit from ordinary activities before tax was INR 18.504 million compared to INR 11.713 million a year ago.

4. Net profit was INR 18.504 million compared to INR 11.713 million a year ago.

5. Profit from operations before other income, interest and exceptional items was INR 82.31 million compared to INR 65.37 million a year ago.

6. Profit from ordinary activities before tax was INR 33.54 million compared to loss from ordinary activities before tax of INR 22.39 million a year ago.

7. Net profit was INR 33.54 million compared to net loss of INR 22.39 million a year ago.

8. Basic and diluted earnings per share before and after extraordinary items was INR 1.53 compared to loss per share of INR 1.02 a year ago.

Expansion Plants

Currently the company has 3 manufaturing plants in Uttaranchal, Himachal Pradesh and Assam with 40 top-of-the-line machines from global machinery giants, modern air-conditioned infrastructure, established in strategic locations which make business sense for our clients, our manufacturing facilities are the best in the business. Company is now looking to move to southern India with an upcoming manufacturing facility on the eastern coast.

No Compromise to Quality

In line with clients’ expectations especially in the food, beverage and pharmaceutical sectors, all 3 plants of the company are ISO: 22000-2005 and following the standard manufacturing processes as prescribed. Recently company achieved the prestigious SEDEX certification. Currently it is in the pursuit of BRC certification to further upgrade our facilities for food and pharma clients.

Shareholding Pattern

From a low of nearly 20% in 2010, promoters have increased the stake to 73% in the last 6 years which shows the growing confidence of company to tap the Indian market further and deliver good results. Sayaji Rao Ketineni and his son Satish Rao Ketineni who is a graduate in business administation from the University of Windsor, Canada are running the company. Satish is the much needed young blood that in combination with his father’s vast experience and wisdom has made ITPL grow leaps and bounds into a major player in this industry.

The Big News - Open Offer to Jauss Polymers

Realizing the potential of the untapped market, it seems Innovative Tech Pack is the front runner is acquiring 26% of Jauss Polymers,another company in the same industry which is giving healthy results in the last 2-3 years. Company is already holding 17.12% of Jauss Polymers. If the deal materialize, the total holding will increase 43.12%. Since the deal is not finalized we are not commenting on this further.

Currently Innovative Tech Pack is trading at a PE of 13 and at a market price of Rs.24.5

As always investment decision is yours!!

One can invest small amount to begin with since its a small cap

ReplyDeleteHello sir @IndianHiddenGems I bought some shares @32•5 .Please suggest me to hold or book loss as it seems to be a completely operated script.Regards

ReplyDeleteSir

ReplyDeletereview result of innovative tech. I purchase 2500 share RS.27 to 33.90 upper circuit.Result excellent but share going down-down ,and l/c.Please suggest me now hold or buy more or EXIT.

with regard

Ravinder walia

kumarravi06@rediffmail.com

Hey, thanks for the information. your posts are informative and useful. I am regularly following your posts.

ReplyDeleteICICI Prudential